If you’re looking to create an estate plan, you may have considered going to an online service and doing it yourself. Speaking with an attorney may seem like overkill, especially if you feel your situation is simple. In many cases, an individual’s first encounter with an attorney is to discuss their estate plan, which can be daunting. However, using a DIY solution should be carefully considered, given the significant consequences of putting together a defective estate plan. Finding the right attorney who listens and guides you through the process far outweighs the supposed ease, simplicity and “cost savings” of an online solution.

to create an estate plan, you may have considered going to an online service and doing it yourself. Speaking with an attorney may seem like overkill, especially if you feel your situation is simple. In many cases, an individual’s first encounter with an attorney is to discuss their estate plan, which can be daunting. However, using a DIY solution should be carefully considered, given the significant consequences of putting together a defective estate plan. Finding the right attorney who listens and guides you through the process far outweighs the supposed ease, simplicity and “cost savings” of an online solution.

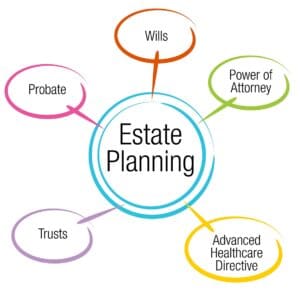

More than the sum of its parts – a Will, Durable Power of Attorney and Living Will – an estate plan should be viewed as a thoughtful undertaking that will ensure your wishes are followed, assets are protected, and goals are met. Without the guidance and knowledge of an experienced professional, many of your goals may not be met.

There are significant risks using an online estate planning tool, including inaccurate and possibly invalid documents that are not in agreement with your wishes.

If you’re asking what may go wrong, consider these potential complications:

Wills. Generally, a Will outlines who receives property after you die (beneficiaries), how that property is distributed and who can act on the deceased person’s behalf (fiduciaries). While these issues might seem straightforward, there are significant issues to consider that may be overlooked without the assistance of an attorney:

- What happens if a beneficiary dies prior to the individual who signed the Will? Some Wills have the deceased individual’s property going to his/her children. In other instances, the deceased individual’s gift would be cancelled. Further complicating matters, if the Will is silent as to a deceased beneficiary, there are default laws in place in most states that would govern.

- A Will only disposes of “probate property” and does not handle property that passes by operation of law (such as jointly owned property or assets payable on death). Distribution of non-probate property must also be considered in preparing an estate plan. Beneficiary designations are an often-overlooked aspect of the process and generally are not addressed in DIY estate planning.

- Should assets be put in trust for a beneficiary? There are pros and cons to establishing a trust, and those concerns should be understood by the individual signing a Will. Trusts should be considered for minor or disabled beneficiaries, in situations where there are creditor or marital problems for the beneficiary, as well as for tax planning purposes. Understanding why a trust should be established, as well as the proper structure for a trust, cannot be answered with an online tool.

- Who should your fiduciaries be? This includes a Guardian for minor children, Executor, Trustee, and Custodian. Sometimes the best fiduciaries will be close family members, and in other circumstances, a corporate fiduciary should be considered. Successor fiduciaries should also be carefully chosen.

- Are the documents properly executed? A Will must be signed in accordance with very specific rules, and if the formalities are not followed, the Will might be invalid or subject to challenge.

Durable Powers of Attorney. A Durable Power of Attorney authorizes an individual (the “Agent”) to handle one’s financial affairs and is typically used only if the person (the “Principal”) is incapacitated or unable to handle their finances. If executed in accordance with the law, the Durable Power of Attorney generally waits for “something bad to happen,” when someone can step into the role as fiduciary for finances. If a Power of Attorney is not executed in accordance with legal requirements, it is likely that one’s family members would have to apply to obtain a court-supervised guardianship. This will cost significant time, money, and stress instead of allowing the focus to be on management of the Principal’s finances.

- The Agent can be one or more individuals, empowered to act on the Principal’s behalf. Sometimes co-Agents are appointed and determining the right circumstance for co-Agents to serve is an important consideration.

- The Principal can give optional broad authority to the Agent to make gifts and transfer the Principal’s assets for the benefit of others. It is important to discuss when these broad powers should be granted.

- If the Principal does not execute a Power of Attorney properly, it is likely that a guardianship proceeding would be required, which would result in significant litigation costs and involvement by the Court in the Principal’s affairs.

Living Wills. A Living Will authorizes an Agent to handle one’s medical affairs and is generally in effect only upon one’s incapacity. If a Living Will is not properly executed, state law sets forth who can make medical decisions on one’s behalf.

- The Living Will essentially acts as your spokesperson for your medical treatment, allowing you to control the situation even if you are incapacitated. For example, it could set forth your wishes with respect to standards of care for end of life, organ donation, etc.

- Like a Durable Power of Attorney, the Agent can be one or more individuals.

- Consideration should be made whether the Agent is willing and capable of making medical and end-of-life decisions on behalf of the individual.

How confident can you be that online estate planning tools “understand” your issues and can produce a product that suits your needs? While they may appear less expensive options, there could be adverse tax consequences, litigation and frustration for your loved ones if done improperly. The best way to develop an estate plan that accurately reflects your goals is by having an experienced estate planning attorney who knows you, will spend time understanding your wishes, and is capable of drafting a plan that coincides with what you want.

Reprinted with permission from the Spring 2022 Edition of Network Magazine © 2022 All rights reserved. Further duplication without permission is prohibited.