There are many reasons real estate taxes go unpaid. In the Commonwealth, a taxing district – the County, School District and Municipality – may seek to initially recoup taxes via Upset Sales. Generally dictated by Pennsylvania Real Estate Tax Sale Law (RETSL), these sales take place annually in September.

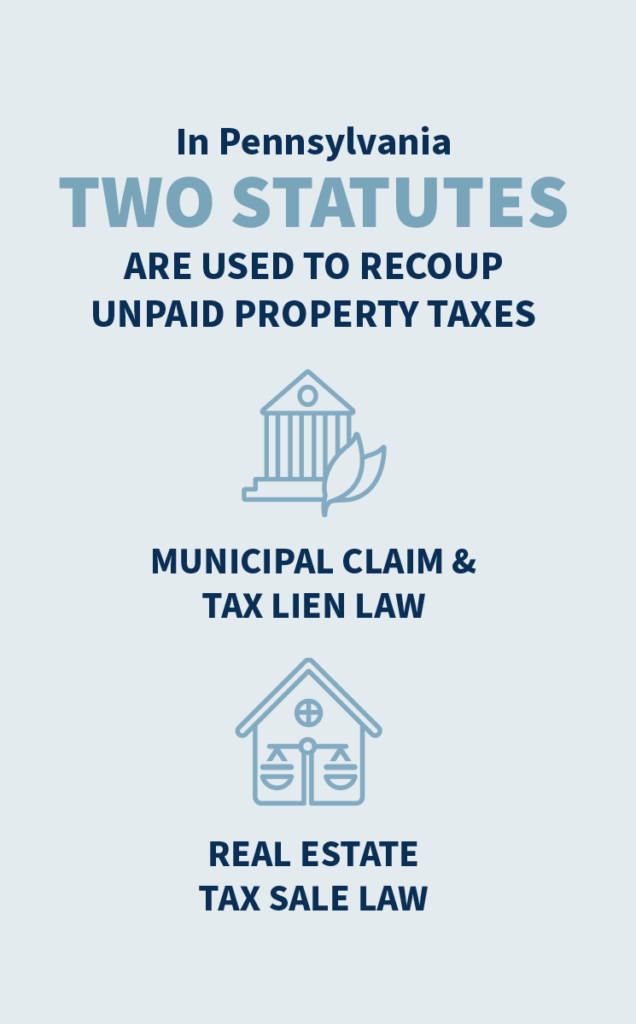

Because a tax sale is the government selling private property, there are legal rules and procedures that must be followed strictly to withstand constitutional scrutiny and due process challenges, and tax sales are often set aside by the courts.

Sometimes, a property will go unsold and unchallenged at Upset Sale, after which it may go up for Judicial Sale or even Private Sale, often creating desirable opportunities for real estate investors. Even at these phases, the taxpayer still has rights and may have a defense in court against such sales.

Access our “Comprehensive Guide to Navigating Tax Sale Opportunities, Hardships and Defense” now, simply by filling out the form below: